Managing your remote service business means juggling a lot — and invoicing shouldn’t be another stress on your plate. You need a tool that’s easy to use, won’t break the bank, and helps you get paid faster.

Imagine having invoicing software that fits perfectly with your remote workflow, saving you time and keeping your cash flow steady. You’ll discover affordable invoicing software options designed specifically for remote service businesses like yours. Stick around, because finding the right invoicing solution could be the game-changer your business needs to thrive effortlessly.

Benefits Of Invoicing Software

Invoicing software helps remote service businesses work smarter and faster. It reduces errors and saves time by automating billing tasks. This makes managing payments easier and improves overall business efficiency.

Using the right invoicing tool can lower costs and boost cash flow. It also simplifies the billing process, making it clear and professional. Remote teams can stay organized and focus on their work without worrying about paperwork.

Cost Savings For Remote Businesses

Invoicing software cuts down on manual work and mistakes. This reduces the need for extra staff or expensive accounting services. Many affordable options offer free plans or low monthly fees. These tools reduce printing and mailing costs by sending invoices electronically.

Remote businesses avoid delays and fees by sending invoices quickly. Automated reminders help get payments on time. This lowers late payment penalties and improves business cash flow. Overall, invoicing software saves money and helps keep budgets on track.

Streamlined Billing Process

Invoicing software organizes billing tasks in one place. It creates, sends, and tracks invoices automatically. Clients receive clear, professional invoices without delays. This reduces confusion and speeds up payment collection.

Templates and customization options make invoices look consistent. Businesses can add logos, payment terms, and notes easily. Automatic calculations prevent errors in totals or taxes. The streamlined process saves time for both businesses and clients.

Improved Cash Flow Management

Invoicing software tracks all payments in real time. This helps businesses see who owes money and when it is due. Automated reminders encourage faster payments from clients. This reduces late payments and improves cash availability.

Reports and dashboards provide clear insights into finances. Businesses can plan expenses and investments better. Managing cash flow becomes simpler and more accurate. This supports steady growth and financial stability for remote service businesses.

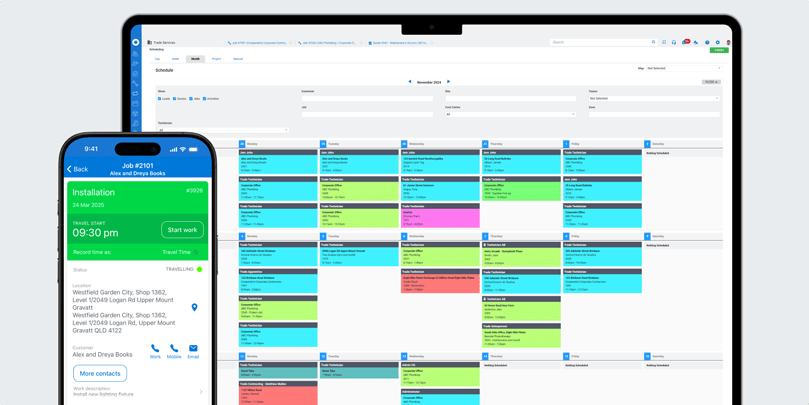

Credit: www.simprogroup.com

Key Features To Look For

Choosing the right invoicing software is crucial for remote service businesses. The software must simplify billing and save time. Certain features ensure smooth operation and better client management. These key features help you handle invoices without hassle and keep your cash flow steady.

User-friendly Interface

The software should be easy to use for everyone on your team. A clean design with simple navigation reduces errors. Quick access to important tools speeds up invoice creation. This saves time and lowers stress, especially for non-tech users.

Customization Options

Invoices must reflect your brand and business style. Look for software that lets you add logos and change colors. Custom fields allow you to include specific details for each client. This personal touch builds trust and looks professional.

Automation And Reminders

Automation reduces repetitive work and avoids missed payments. The software should send invoices automatically after service completion. It should also send payment reminders to clients on time. This keeps your income steady without extra effort.

Multi-currency And Tax Support

Remote businesses often work with clients worldwide. The software must handle multiple currencies easily. It should also calculate taxes correctly based on client location. This feature simplifies international billing and ensures compliance.

Top Affordable Software Options

Finding the right invoicing software helps remote service businesses manage payments easily. Affordable options offer strong features without high costs. These tools support billing, tracking, and client management effectively. Here are some top affordable software choices to consider.

Zoho Invoice For Free Plans

Zoho Invoice provides a solid free plan for small businesses. It allows unlimited invoices and clients with basic features. The interface is simple and easy to use. Zoho Invoice supports multiple currencies and automated reminders. It suits startups and freelancers who want no-cost invoicing.

Freshbooks Trial Benefits

FreshBooks offers a free trial to test its full features. It includes time tracking, expense management, and detailed reports. Users get access to professional invoice templates. The trial helps businesses decide if FreshBooks fits their needs. It works well for service providers requiring all-in-one solutions.

Square Invoices For Unlimited Billing

Square Invoices allows unlimited invoicing without monthly fees. It is ideal for businesses with many clients. The software integrates with payment processing easily. Users can send invoices via email or SMS. Square also offers tracking and payment reminders.

Harvest For Freelancers

Harvest focuses on freelancers and small teams. It combines invoicing with time tracking and project management. The free plan supports up to two projects. Harvest’s reports show billable hours clearly. This software helps freelancers stay organized and paid on time.

Stripe Invoicing For International Sales

Stripe Invoicing supports global payments with multiple currencies. It works well for remote businesses with international clients. The platform offers flexible billing options and customizable invoices. Stripe’s payment processing is fast and secure. It fits businesses expanding beyond local markets.

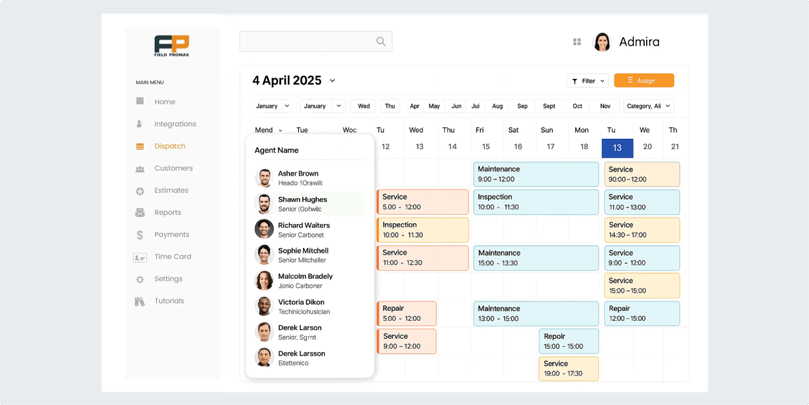

Credit: reverbico.com

Using Google Templates For Free Invoicing

Using Google templates for free invoicing offers a simple way to create professional invoices. Remote service businesses can benefit from these ready-made designs without extra costs. These templates help save time and keep your billing clear and organized.

Google’s cloud-based tools make managing invoices easy from anywhere. You can access, edit, and send invoices quickly. This method suits businesses that need affordable and flexible invoicing solutions.

Accessing Templates In Google Docs And Sheets

Open Google Docs or Sheets in your browser. Click on the “Template gallery” at the top right corner. Find the invoice templates under the available options. Choose one that fits your needs and click to open it. The template will load as a new document or spreadsheet, ready for editing.

Customizing Templates To Fit Your Brand

Edit the template’s text fields with your business details. Add your company name, logo, and contact information. Change colors and fonts to match your brand style. Update item descriptions, prices, and payment terms. This customization makes your invoices look professional and consistent.

Saving And Sharing Invoices Via Cloud

Save your customized invoice directly in Google Drive. It stores your files safely and allows access from any device. Share invoices by sending a link or exporting as PDF. Clients receive clear and easy-to-open documents. This cloud storage reduces the risk of losing important billing information.

Collaboration Features For Remote Teams

Google Docs and Sheets let multiple users edit the same invoice. Assign editing or viewing permissions to team members. Collaborate in real-time to update billing details or check accuracy. Comments and suggestions help improve communication. These features support smooth teamwork for remote businesses.

Comparing Pricing And Plans

Choosing the right invoicing software means understanding pricing and plans. Many options offer free and paid versions. Each plan has different features. Knowing these differences helps remote service businesses pick software that fits their budget and needs. Some costs may not be obvious at first. Watching out for these hidden fees keeps your expenses clear and manageable.

Free Vs Paid Versions

Free versions offer basic invoicing tools. They suit freelancers or very small teams. Paid versions provide more features and support. They often allow more invoices, clients, or users. Some paid plans also include faster payments and integrations. Deciding between free and paid depends on business size and invoice volume. Start with free if unsure, then upgrade as needs grow.

Features Included In Each Tier

Basic tiers usually cover invoice creation and sending. Paid tiers add time tracking, expense management, and custom branding. Higher plans may include automated reminders and advanced reports. Some offer multi-currency support and tax management. Look for features that save time and reduce errors. Prioritize tools that improve cash flow and client communication.

Hidden Costs To Watch Out For

Watch for fees like transaction charges or limits on invoices. Some software charges extra for additional users or clients. Support beyond email or chat may cost extra. Integration with other tools can add fees. Always read terms carefully before committing. Hidden costs can increase your monthly bill unexpectedly. Choose software with transparent pricing to avoid surprises.

Tips For Choosing The Right Software

Choosing the right invoicing software is essential for remote service businesses. It helps manage billing smoothly and saves valuable time. The right software matches your business needs and supports growth. Consider key factors to make a smart choice.

Assessing Business Size And Needs

Start by understanding your business size. Small teams need simple, easy-to-use tools. Larger teams may require more features and user accounts. Identify your invoicing volume and complexity. Choose software that fits your current tasks and future growth.

Considering Integration Capabilities

Check if the software connects with other tools you use. Integration with accounting, payment, and project management apps saves time. It reduces manual entry and errors. Look for software that syncs data smoothly with your existing systems.

Evaluating Customer Support Options

Good support ensures quick help when problems arise. Find software with multiple support channels like chat, email, or phone. Test response times and support quality. Reliable customer service keeps your invoicing process running without delays.

Maximizing Efficiency With Invoicing Tools

Invoicing tools help remote service businesses save time and reduce errors. They make billing simple and fast. Efficiency improves as manual tasks decrease. Accurate invoices and clear payment tracking become easy.

Using invoicing software, businesses manage money flow better. This allows focus on providing great service. Automated features handle repetitive tasks and keep records organized. Reports show financial health clearly.

Automating Recurring Invoices

Recurring invoices send automatically on set dates. This saves time for monthly or weekly clients. It stops late billing and missed payments. The software creates and sends invoices without manual work. Businesses keep steady cash flow and improve client trust.

Tracking Payments And Overdue Bills

Invoicing tools track payments clearly and in real-time. They show which bills are paid and which are overdue. Alerts notify businesses about late payments. This helps to follow up quickly and avoid cash gaps. Clear payment status improves client communication and money management.

Generating Financial Reports

Reports provide insights into income and expenses. They help identify top clients and slow payers. Businesses see trends and plan budgets better. Reports are easy to create with invoicing tools. They support smart decisions and business growth.

Credit: www.simprogroup.com

Frequently Asked Questions

What Is The Best Invoicing Software For Small Businesses?

The best invoicing software for small businesses includes Zoho Invoice for free plans, FreshBooks for trials, Stripe for international sales, Square for unlimited invoices, and Harvest for freelancers. These options offer affordability, ease of use, and essential features tailored to small business needs.

What Is The Cheapest Billing Software?

The cheapest billing software often includes free options like ProfitBooks and Zoho Invoice. Google also offers free customizable invoice templates. These tools suit startups and small businesses seeking cost-effective billing solutions.

Does Google Have A Free Invoice Generator?

Yes, Google offers free invoice templates in Google Docs and Sheets. Customize and save them easily in Google Drive.

Is Zoho Invoice Actually Free?

Yes, Zoho Invoice offers a free plan with essential features for small businesses. It supports unlimited invoices and clients.

Conclusion

Affordable invoicing software helps remote service businesses save time and money. It simplifies billing and keeps finances organized. Many options offer easy setup and useful features for small budgets. Choosing the right tool improves cash flow and client trust. Try free versions or templates to test what fits best.

Staying consistent with invoicing makes business smoother and more professional. Keep your process simple, clear, and affordable to grow steadily.