Managing payroll for remote contractors can quickly become overwhelming. You might find yourself tangled in spreadsheets, tax forms, and payment schedules that eat up your valuable time.

What if you could cut through this complexity and handle everything smoothly, accurately, and on time? This is exactly where the right tools for automating payroll step in to transform your process. You’ll discover how these tools can save you hours, reduce costly errors, and keep your remote contractors happy with timely payments.

Keep reading to find the best solutions tailored for your needs and learn how to make payroll one less thing to worry about.

Benefits Of Payroll Automation

Automating payroll for remote contractors offers many clear advantages. It saves time, reduces mistakes, and keeps your business compliant with laws. Automation simplifies complex tasks, making payroll management easier and faster. This leads to happier contractors and smoother business operations.

Time Savings And Efficiency

Payroll automation handles calculations quickly and accurately. It removes the need for manual data entry and repetitive tasks. This frees up time for other important work. Automated systems process payments on schedule without delays. They allow businesses to pay remote contractors faster and more reliably.

Reducing Errors And Ensuring Compliance

Manual payroll processes often cause errors in wages and taxes. Automation minimizes these mistakes by using precise algorithms. It also tracks changes in labor laws and tax rules. This helps businesses avoid costly penalties and legal problems. Automated payroll systems keep records organized and accurate at all times.

Streamlining Tax Calculations And Filings

Payroll automation calculates taxes correctly for each contractor. It considers local, state, and federal tax regulations. The system can generate and file tax forms automatically. This reduces the burden of paperwork and the risk of missing deadlines. Businesses can focus on growth instead of tax complexities.

Challenges With Remote Contractor Payroll

Managing payroll for remote contractors presents unique challenges. These challenges arise from differences in tax laws, payment preferences, and tracking work hours. Businesses must navigate these issues carefully to ensure smooth and accurate payroll processing.

Many companies struggle with staying compliant and paying contractors correctly. Errors can lead to fines or unhappy contractors. Understanding the common hurdles helps businesses find the right tools to automate payroll effectively.

Managing Diverse Tax Regulations

Remote contractors often work in different states or countries. Each location has its own tax rules and reporting requirements. Staying updated on these rules is complex and time-consuming.

Incorrect tax handling can result in penalties and delays. Businesses must collect tax forms, calculate deductions, and file reports properly. Automation tools help by integrating tax updates and ensuring compliance.

Handling Multiple Payment Methods

Contractors prefer various payment methods, such as bank transfers, PayPal, or digital wallets. Managing these methods manually wastes time and causes confusion.

Payment errors can damage trust and delay work. Automated payroll systems support multiple payment options. They streamline payments and keep records accurate and organized.

Ensuring Accurate Time Tracking

Tracking hours for remote contractors is challenging without direct supervision. Inaccurate time logs affect payroll accuracy and project budgets.

Manual tracking often leads to errors or fraud. Automated time tracking tools capture hours reliably. They integrate with payroll systems to calculate payments correctly and on time.

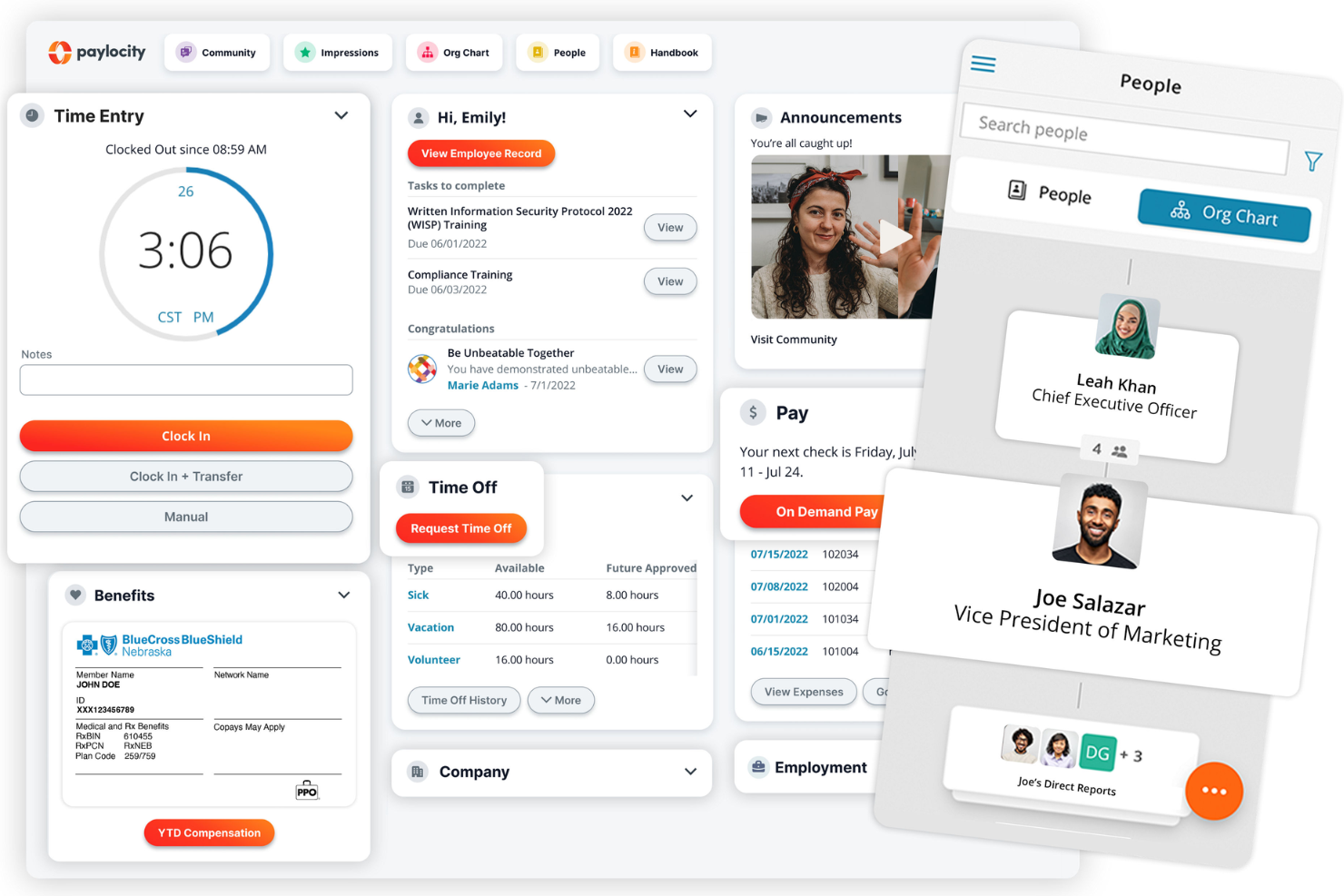

Top Payroll Automation Tools

Managing payroll for remote contractors can be complex and time-consuming. Payroll automation tools simplify this task by handling calculations, tax deductions, and payments. These tools reduce errors and save valuable time for businesses. Choosing the right software is essential for smooth payroll processing. Below are some of the top payroll automation tools designed for remote contractors.

Square Payroll

Square Payroll automates wage calculations and tax deductions. It supports direct deposit for fast and secure payments. The system files and pays local, state, and federal payroll taxes. This reduces the risk of mistakes and keeps your business compliant.

Deel

Deel specializes in global payroll for remote teams. It handles payments in multiple currencies and tax compliance worldwide. Deel also offers contract management and easy onboarding. This makes paying international contractors simple and efficient.

Papaya Global

Papaya Global integrates payroll, payments, and workforce management. It supports contractors and employees in many countries. The platform ensures compliance with local labor laws and tax regulations. Payroll runs smoothly across borders with this tool.

Ramp

Ramp focuses on automating payroll and expense management. It helps track spending and control budgets easily. The platform also automates payroll tax filings. Ramp reduces manual work and improves accuracy for remote teams.

The Access Group

The Access Group offers a comprehensive payroll solution for businesses of all sizes. It automates salary calculations and tax reporting. The software integrates well with HR systems for seamless operations. It supports compliance with changing payroll laws.

How Ai Enhances Payroll Automation

Artificial intelligence (AI) plays a key role in improving payroll automation for remote contractors. It handles repetitive tasks quickly and precisely. This reduces the chance of human mistakes and saves time.

AI tools work around the clock. They help payroll teams focus on more important work. These tools also improve compliance and the overall employee experience.

Automating Data Entry And Calculations

AI automatically gathers and inputs payroll data. It checks the data for accuracy before processing. Calculations for wages, taxes, and deductions happen instantly. This cuts down on manual work and speeds up payroll cycles.

Detecting Errors And Anomalies

AI systems scan payroll records to find errors or unusual patterns. They spot mistakes like incorrect hours or missing details. The system alerts payroll staff to review and fix these issues early.

Maintaining Compliance With Regulations

AI keeps track of changing tax laws and labor rules. It applies the correct rates and deductions based on location. This helps avoid costly penalties and legal problems for the business.

Improving Accuracy

AI reduces human errors by double-checking every payroll entry. It ensures calculations are precise and consistent. Accuracy boosts trust and satisfaction among remote contractors.

Enhancing Employee Experience

AI-powered chatbots answer payroll questions anytime. Employees can access pay stubs and tax forms instantly. This transparency and support improve worker happiness and loyalty.

Providing Predictive Analytics

AI analyzes payroll data to predict future costs and trends. It helps companies plan budgets and manage cash flow better. Predictive insights guide smarter decisions for workforce management.

Ai’s Role In Payroll Management

Artificial Intelligence (AI) plays a growing role in payroll management for remote contractors. It helps handle repetitive tasks quickly and accurately. AI tools reduce errors and speed up payroll processes.

With AI, payroll teams can focus more on complex tasks and less on manual data entry. This balance improves efficiency and accuracy. Remote payroll becomes easier to manage with AI support.

Supporting Payroll Professionals As A Co-pilot

AI acts as a co-pilot for payroll professionals. It automates calculations and data entry. This reduces mistakes caused by manual work. AI also checks for errors and flags unusual data.

Payroll staff receive alerts for any inconsistencies. This helps them fix issues before processing payments. AI provides reports and insights that assist decision-making. It supports, not replaces, human expertise in payroll tasks.

Balancing Automation With Human Oversight

Automation speeds up payroll but human oversight remains essential. AI handles routine tasks but complex cases need human review. Payroll professionals ensure rules and compliance are followed correctly.

Humans interpret AI alerts and make final decisions. This balance prevents errors and legal problems. Combining AI with human judgment creates a reliable payroll system. It keeps remote contractor payments accurate and on time.

Credit: www.hh2.com

Choosing The Right Tool For Your Business

Choosing the right tool for automating payroll of remote contractors is essential for smooth business operations. The right software saves time and reduces mistakes. It also ensures your payments comply with tax laws. Selecting a tool that fits your needs improves efficiency and keeps your contractors happy.

Not every payroll tool suits every business. Consider your specific requirements carefully. Focus on features, costs, and user experience. This approach helps find a reliable tool that grows with your company.

Evaluating Features And Integrations

Check if the tool handles multiple currencies and tax rules. Look for automated tax calculations and filings. Integration with accounting and time-tracking software is important. It reduces manual work and errors. Verify if the tool supports direct deposits worldwide. Ensure it can generate clear payroll reports and payslips.

Considering Scalability And Cost

Choose a tool that adapts to your business size. It should work well for a few contractors and many. Consider subscription fees and extra charges. Some tools charge per user or transaction. Balance cost with the features offered. Avoid paying for features you will not use.

Prioritizing User Experience And Support

Pick a tool with a simple, clear interface. Contractors and managers should find it easy to use. Quick access to customer support matters. Responsive help saves time and prevents frustration. Look for tutorials or guides to assist users. Good support ensures smooth payroll processing every cycle.

Future Trends In Payroll Automation

Payroll automation is evolving rapidly, especially for managing remote contractors. New technologies promise smarter, faster, and more accurate payroll processes. These advancements help businesses handle complex payment rules and diverse workforces with ease.

Automation tools will soon offer more than simple calculations. They will bring deeper insights and seamless integration with other financial systems. This shift will improve accuracy and reduce the time spent on payroll tasks.

Expansion Of Ai Capabilities

Artificial intelligence will play a bigger role in payroll automation. AI can now handle routine tasks like data entry and calculations. Soon, AI will also predict payroll trends and detect errors before they happen.

AI will assist in compliance by adapting to new tax laws automatically. This reduces risks and ensures payments follow local regulations. Payroll systems with AI will offer personalized support through chatbots, answering employee questions instantly.

Integration With On-demand Pay Systems

On-demand pay lets workers access earned wages anytime. Payroll tools will integrate with these systems to offer flexible payment options. This helps remote contractors manage their finances better and reduces payment delays.

Automation will streamline how on-demand pay interacts with regular payroll. It will track hours worked and instantly calculate available pay. This integration improves cash flow and worker satisfaction without extra administrative work.

Global Payroll Management Solutions

Managing payroll across countries is complex. Future tools will simplify global payroll by handling multiple currencies and tax laws automatically. Businesses can pay remote contractors worldwide without worrying about compliance issues.

These solutions will offer centralized dashboards to monitor payments and tax filings. They will also provide local support to address specific country rules. This makes global payroll management efficient and less error-prone.

Credit: remote.com

Credit: peoplemanagingpeople.com

Frequently Asked Questions

Is There A Way To Automate Payroll?

Yes, payroll automation uses software to calculate wages, deduct taxes, and process payments accurately and quickly. AI tools reduce errors and ensure compliance.

Can You Do Payroll Remotely?

Yes, you can manage payroll remotely using specialized software or outsourcing services. These tools automate calculations, tax filings, and payments efficiently.

Can Ai Do My Payroll?

Yes, AI can handle payroll tasks like calculations, error detection, and compliance checks. It assists professionals but doesn’t fully replace them.

Can Payroll Be Fully Automated?

Yes, payroll can be fully automated using software that handles calculations, tax deductions, payments, and compliance. Automation reduces errors and saves time while ensuring accurate, timely payroll processing for businesses of all sizes.

Conclusion

Automating payroll for remote contractors saves time and reduces errors. Choosing the right tools helps ensure accurate payments and compliance. These tools simplify tax calculations and reporting tasks. They also improve overall payroll efficiency and employee satisfaction. Investing in automation supports smooth business operations.

Keep your payroll process simple and reliable with the best solutions.