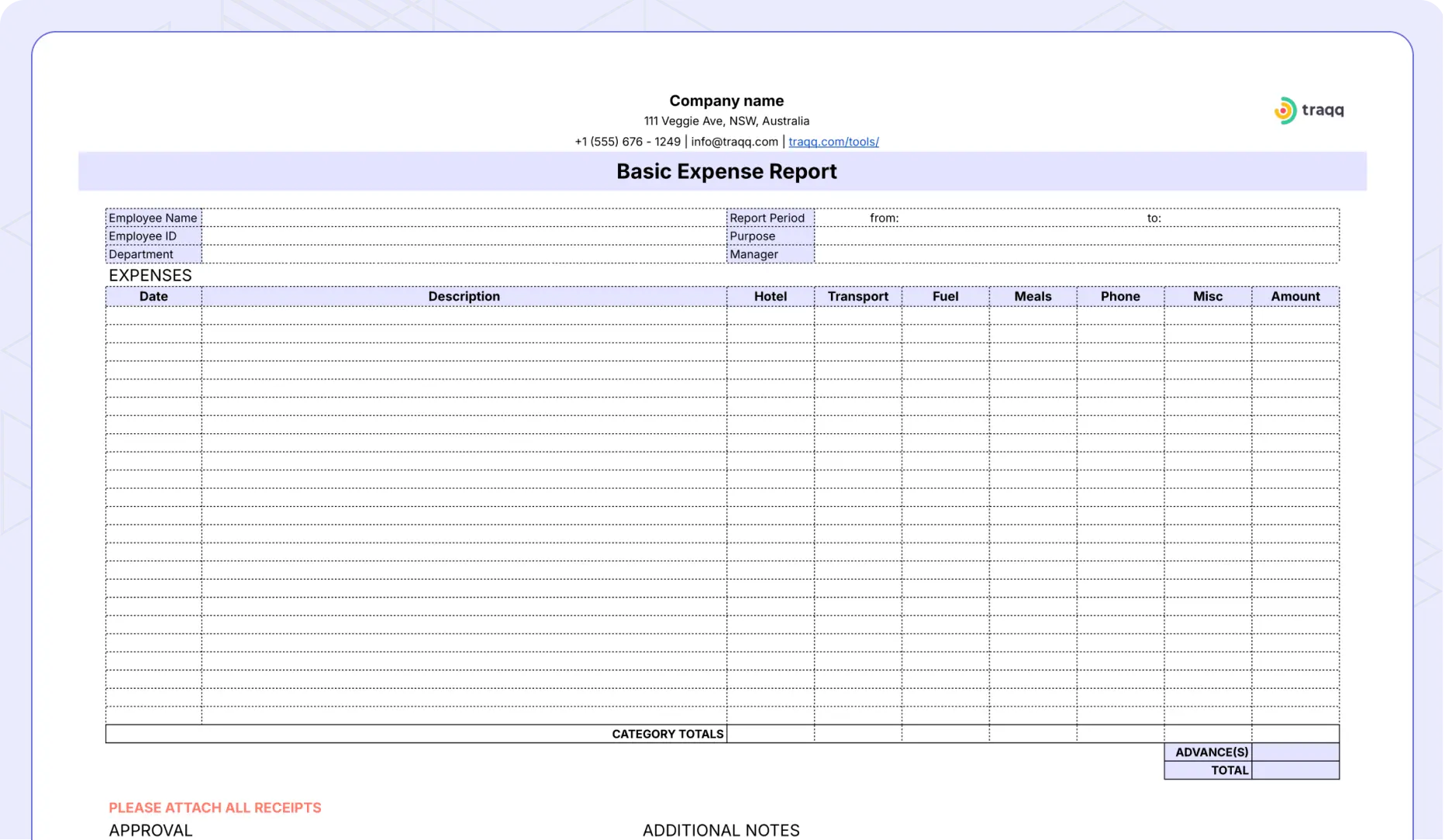

Managing your expenses as a remote contractor can quickly become overwhelming without the right tools. You want to keep track of every receipt, invoice, and payment, but doing it all manually eats up your time and energy.

What if there was a way to simplify this process without breaking the bank? Affordable expense tracking tools are designed to help you stay organized, save money, and focus more on your work. You’ll discover easy-to-use, budget-friendly solutions that make managing your finances stress-free and efficient.

Keep reading to find the perfect tool that fits your needs and helps you take control of your remote contracting business.

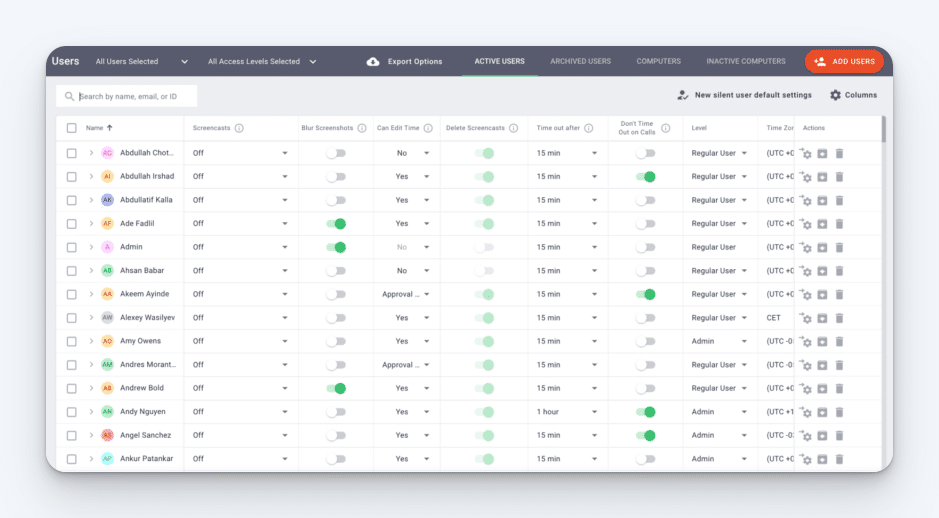

Credit: traqq.com

Separate Business Finances

Keeping business and personal finances separate is essential for remote contractors. It simplifies expense tracking and helps maintain clear records. Separate finances prevent confusion and save time during tax season. It also strengthens your business’s financial credibility with banks and clients.

Using dedicated tools and accounts makes managing expenses easier. You can track income and costs accurately. This practice supports better budgeting and financial decision-making for your business.

Open Dedicated Bank Account

Opening a separate bank account for your business is a smart move. It keeps your business money apart from personal funds. This clear division makes it easier to track all business transactions. Banks often offer accounts designed for small businesses. These accounts may include useful features like online banking and expense tracking tools.

Use this account to deposit all business income and pay for business expenses. Avoid mixing personal purchases with business transactions. This habit helps during audits and tax filing. It also provides a clear financial picture of your business.

Use Business Credit Cards

Business credit cards offer another way to separate expenses. Charge only business-related costs on these cards. This keeps personal and business spending distinct. Many business cards provide rewards or cashback on purchases. Some also offer tools to monitor and categorize expenses automatically.

Using a business credit card helps build your company’s credit history. It can be useful for future loans or financing. Always pay your balance on time to avoid fees and interest. Track your credit card statements regularly to catch any errors.

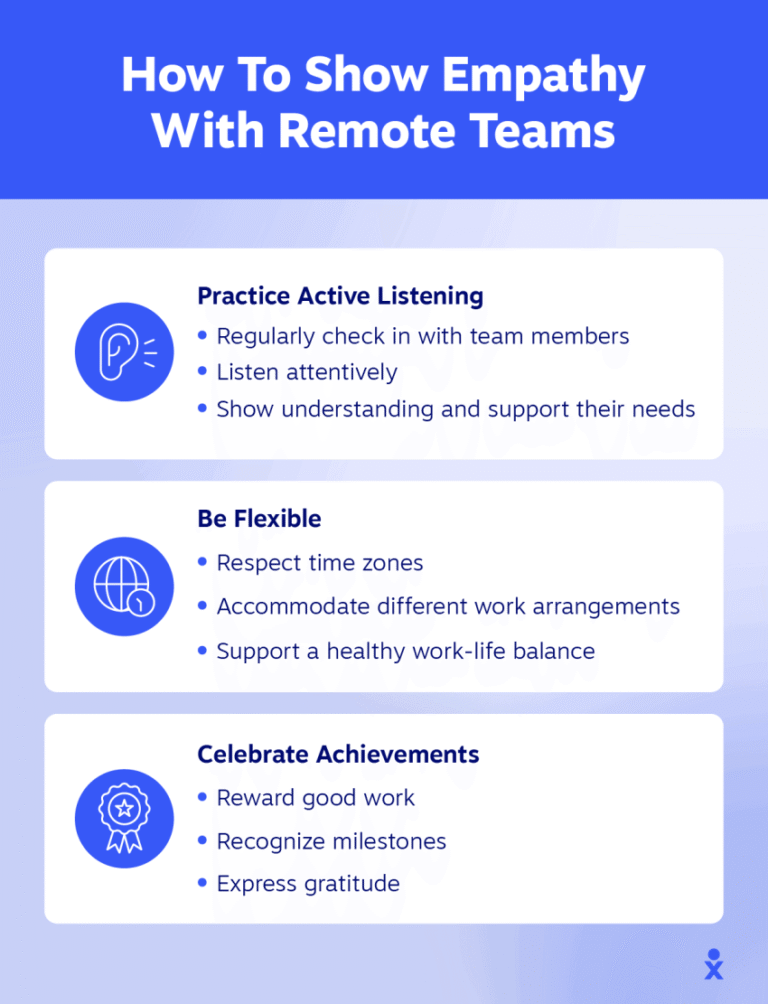

Credit: buddypunch.com

Automate With Accounting Software

Automating your expense tracking with accounting software saves time and reduces errors. Remote contractors benefit from tools that handle financial details automatically. This lets you focus on work instead of paperwork.

Accounting software streamlines your bookkeeping by connecting directly to your financial accounts. It captures transactions and organizes expenses without manual entry. This automation helps keep your records accurate and up-to-date.

Link Bank And Credit Accounts

Connect your business bank and credit accounts to your software. This link pulls all transactions into one place. It avoids missing expenses or income and keeps everything organized.

Linking accounts separates business and personal finances clearly. It simplifies tax reporting and financial reviews. You can check your real-time balance and spending easily.

Auto-import Transactions

Accounting software automatically imports transactions from linked accounts. Each purchase, payment, or deposit appears in your system quickly. This removes the need for manual entry and reduces mistakes.

Auto-imported data is ready to categorize and review. Software often suggests categories based on transaction details. This speeds up bookkeeping and ensures your records are accurate.

Digitize And Organize Receipts

Keeping receipts organized is vital for remote contractors managing expenses. Digitizing receipts saves time and reduces clutter. It creates a simple way to track purchases and prepare for taxes.

Digital receipt management avoids lost papers and messy files. It helps contractors find records quickly. This method also supports accurate expense reporting and better budgeting.

Capture Receipts With Phone

Use your smartphone to snap clear photos of each receipt. Most phones have built-in cameras that work well for this task. Take pictures right after making a purchase to avoid forgetting.

Ensure the entire receipt fits in the frame and is easy to read. Good lighting helps capture details clearly. Some apps even enhance images automatically for better clarity.

Store Receipts Digitally

Upload receipt photos to a cloud storage or expense tracking app. This keeps all documents in one safe place. Choose apps that allow easy sorting by date, amount, or vendor.

Label receipts with notes about the expense for quick reference. Digital storage lets you access receipts from any device, anywhere. This system simplifies tax filing and financial reviews.

Categorize Expenses Efficiently

Organizing expenses clearly helps remote contractors control their finances. Efficient categorization saves time during tax season. It also improves budgeting and cash flow management.

Using the right tools makes sorting expenses simple and fast. Proper labels show where money goes and what costs are recurring. This method prevents confusion and missed deductions.

Assign Expense Categories

Labeling each expense with a clear category is essential. Categories like travel, office supplies, or software fees work well. This step creates a tidy overview of spending habits.

Many expense tracking tools allow custom categories. Remote contractors can tailor these to fit their unique business needs. This customization makes reports more meaningful and actionable.

Regularly updating categories keeps financial records accurate. It helps spot trends and adjust budgets quickly. Assign categories right after recording expenses to avoid mistakes.

Track Tax-deductible Purchases

Not all expenses qualify for tax deductions. Tracking these purchases separately saves money. Contractors should identify and tag deductible items like equipment and travel costs.

Expense tools often include a feature to mark tax-deductible purchases. This simplifies tax filing and reduces errors. Keeping receipts and invoices alongside digital records strengthens claims.

Review deductible expenses monthly to stay organized. Proper tracking prevents last-minute scrambles during tax season. It ensures contractors pay only what they owe.

Maintain Regular Expense Records

Maintaining regular expense records is crucial for remote contractors managing their finances. Keeping detailed and up-to-date expense logs helps avoid confusion and errors. It also makes tax time less stressful and improves financial decision-making. Consistency in recording expenses builds a clear picture of cash flow and spending habits.

Accurate records provide insight into where money goes and help identify areas to cut costs. They support better budgeting and ensure compliance with tax rules. Even simple tools can make a big difference in staying organized and saving time.

Record Expenses Consistently

Track every expense as soon as it happens. Use affordable apps or spreadsheets to log costs daily or weekly. Include details like date, amount, and purpose. Consistency prevents lost receipts and forgotten transactions. Regular updates keep your records accurate and reliable.

Set reminders to review and enter expenses regularly. This habit reduces errors and helps you stay on top of your finances. Consistent records also make it easier to spot unusual charges quickly.

Reconcile With Bank Statements

Match your recorded expenses with bank statements every month. This process verifies that all transactions are captured correctly. It helps identify missing entries or errors early on. Reconciliation keeps your financial data accurate and trustworthy.

Compare each expense in your records with bank and credit card statements. Fix discrepancies immediately to avoid bigger problems later. Regular reconciliation simplifies tax preparation and financial reporting.

Top Expense Tracking Tools

Expense tracking tools help remote contractors manage finances easily. These tools simplify recording and organizing expenses. They save time and reduce errors. Choosing the right tool depends on your needs and budget. Here are top expense tracking tools popular among contractors.

Quickbooks For All-in-one Accounting

QuickBooks offers a complete accounting solution. It tracks expenses, invoices, and payments in one place. The tool links with bank accounts for automatic updates. It supports tax preparation with detailed reports. QuickBooks suits contractors who want a full accounting package.

Freshbooks For User-friendly Tracking

FreshBooks is easy to use and set up. It focuses on simple expense tracking and invoicing. The interface is clean and clear for beginners. Users can upload receipts and categorize expenses quickly. FreshBooks is ideal for contractors new to accounting software.

Zoho Books For Small Business

Zoho Books provides solid features for small businesses. It tracks expenses, manages invoices, and handles taxes. The software integrates with other Zoho apps for smooth workflow. It offers automation to save time on routine tasks. Zoho Books fits small contractors wanting affordable tools.

Everlance For Mileage And Simple Tracking

Everlance focuses on mileage tracking and basic expense logging. It automatically records miles using GPS. Users can capture receipts with their phone camera. The app separates business and personal expenses easily. Everlance works well for contractors who drive often.

Expensify For Real-time Expense Capture

Expensify captures expenses in real time using mobile devices. It scans receipts and logs transactions instantly. The software offers approval workflows for teams. It connects with accounting programs for seamless data transfer. Expensify suits contractors needing quick and accurate expense entries.

Tips For Remote Contractors

Managing finances is crucial for remote contractors. Simple methods help keep expenses clear and organized. This section shares practical tips to track your money efficiently. Follow these steps to stay on top of your income and spending.

Keep Independent Contractor Spreadsheets

Create a spreadsheet to list all your earnings and expenses. This tool helps you see where your money goes. Update it regularly to avoid missing any details. Customize columns for date, description, amount, and category. A well-maintained spreadsheet supports tax filing and budgeting.

Track Both Income And Expenses

Record every payment you receive and all your costs. Tracking both sides gives a full picture of your finances. Note client payments, project fees, and other income sources. Include office supplies, software subscriptions, and travel costs as expenses. This balance helps you understand your profit and plan better.

Use Mobile Apps For On-the-go Tracking

Download expense tracking apps on your phone to log costs anytime. Mobile apps let you capture receipts by taking photos instantly. Sync data across devices to keep records updated wherever you work. Many apps offer simple interfaces and automatic categorization. This convenience saves time and reduces errors.

Frequently Asked Questions

How To Track Expenses As A 1099 Contractor?

Track expenses as a 1099 contractor by using accounting software like QuickBooks. Digitize receipts, categorize costs, and reconcile bank transactions regularly. Maintain a separate business bank account for clear records and tax readiness.

What Is The Best Way To Keep Track Of Expenses For A Small Business?

Use dedicated accounting software like QuickBooks or FreshBooks to link bank accounts, digitize receipts, categorize expenses, and review regularly. Separate business and personal finances with a business account for accurate tracking and easier tax preparation.

Is Expensify Really Free?

Expensify offers a free plan with limited features for individual users. Advanced features require a paid subscription.

What Is The Best Tool For Tracking Expenses?

The best tool for tracking expenses is dedicated accounting software like QuickBooks, FreshBooks, or Zoho Books. These tools link bank accounts, digitize receipts, categorize expenses, and simplify tax preparation for small businesses and contractors.

Conclusion

Affordable expense tracking tools help remote contractors manage money well. These tools simplify keeping receipts and recording costs. Using software saves time and reduces errors. Tracking expenses often gives better control over finances. Choose tools that fit your budget and needs.

Staying organized makes tax time less stressful. Simple steps can improve your business’s financial health. Start small, stay consistent, and watch your tracking improve.