Managing your invoices shouldn’t be a headache, especially when you’re running a remote service business. You need tools that are not only reliable but also affordable—so you can focus on delivering great service without worrying about complicated billing processes.

Imagine having invoicing software that saves you time, keeps your cash flow steady, and fits right into your budget. Curious to find out which invoicing tools can do all this for you? Keep reading, because we’ve rounded up the best affordable invoicing solutions designed specifically for remote service providers like you.

Top Affordable Invoicing Tools

Affordable invoicing tools help remote service providers manage payments easily. These tools save time and reduce errors. They suit small businesses and freelancers who need simple, cost-effective solutions.

Here are some top affordable invoicing tools that combine essential features with budget-friendly pricing. Each offers unique benefits for remote service providers.

Zoho Invoice

Zoho Invoice offers a free plan with many features. Users can create and send professional invoices quickly. It supports multiple currencies and languages. Zoho Invoice automates payment reminders and tracks expenses. It is ideal for freelancers and small businesses.

Wave

Wave provides free invoicing and accounting tools. It lets users customize invoices and accept online payments. Wave also tracks sales tax and generates reports. Its user-friendly interface suits those new to invoicing. Small service providers find it reliable and easy to use.

Square Invoices

Square Invoices offers free invoice creation with simple payment options. It integrates with Square’s payment system for fast transactions. Users can send unlimited invoices without monthly fees. Square Invoices is perfect for remote workers who need quick billing solutions.

Invoice Ninja

Invoice Ninja has a free plan supporting up to 100 clients. It includes time tracking, expense management, and task automation. Users can customize invoices and accept payments online. It works well for freelancers managing multiple projects and clients.

Paymo

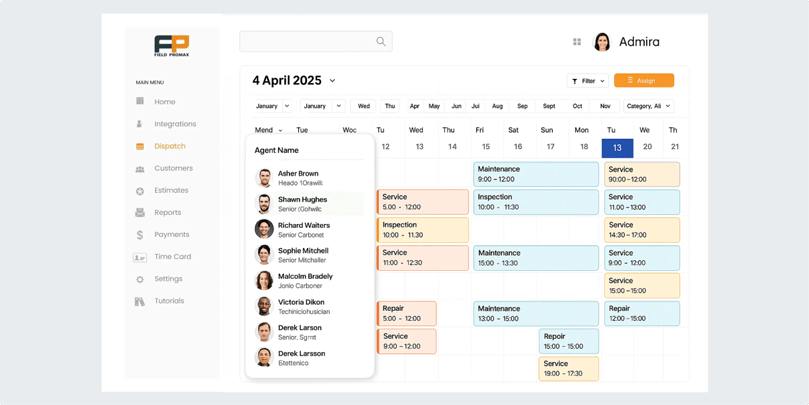

Paymo combines invoicing with project management tools. Its affordable plans offer time tracking and expense logging. Users can create detailed invoices based on tracked time. Paymo suits remote teams and service providers who want all-in-one software.

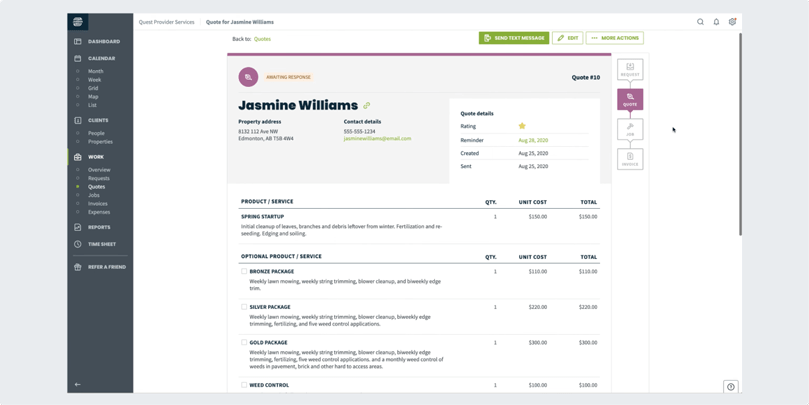

Credit: www.simprogroup.com

Features For Remote Service Providers

Remote service providers need invoicing tools that fit their unique work style. Features tailored to their needs save time and reduce errors. The right tools help keep payments on track from anywhere.

Customizable Templates

Customizable templates let service providers create professional invoices fast. They can add logos, change colors, and edit text easily. This keeps branding consistent and makes invoices look polished. Templates reduce repetitive work and speed up billing.

Online Payment Integration

Online payment integration allows clients to pay instantly via credit cards or digital wallets. This feature cuts down payment delays. It supports popular gateways like PayPal, Stripe, and others. Easy payments improve cash flow and client satisfaction.

Multi-currency Support

Multi-currency support helps remote providers bill clients worldwide. Invoices can display amounts in local currencies. Automatic currency conversion ensures accurate totals. This feature simplifies dealing with international clients and expands business reach.

Invoice Tracking

Invoice tracking shows the status of each invoice in real-time. Providers can see if invoices are sent, viewed, or paid. This visibility helps follow up on overdue payments quickly. Tracking reduces confusion and keeps finances organized.

Automated Reminders

Automated reminders send friendly payment prompts to clients automatically. Providers set schedules for reminders without manual effort. This feature lowers late payments and improves collection rates. It keeps clients informed and payments timely.

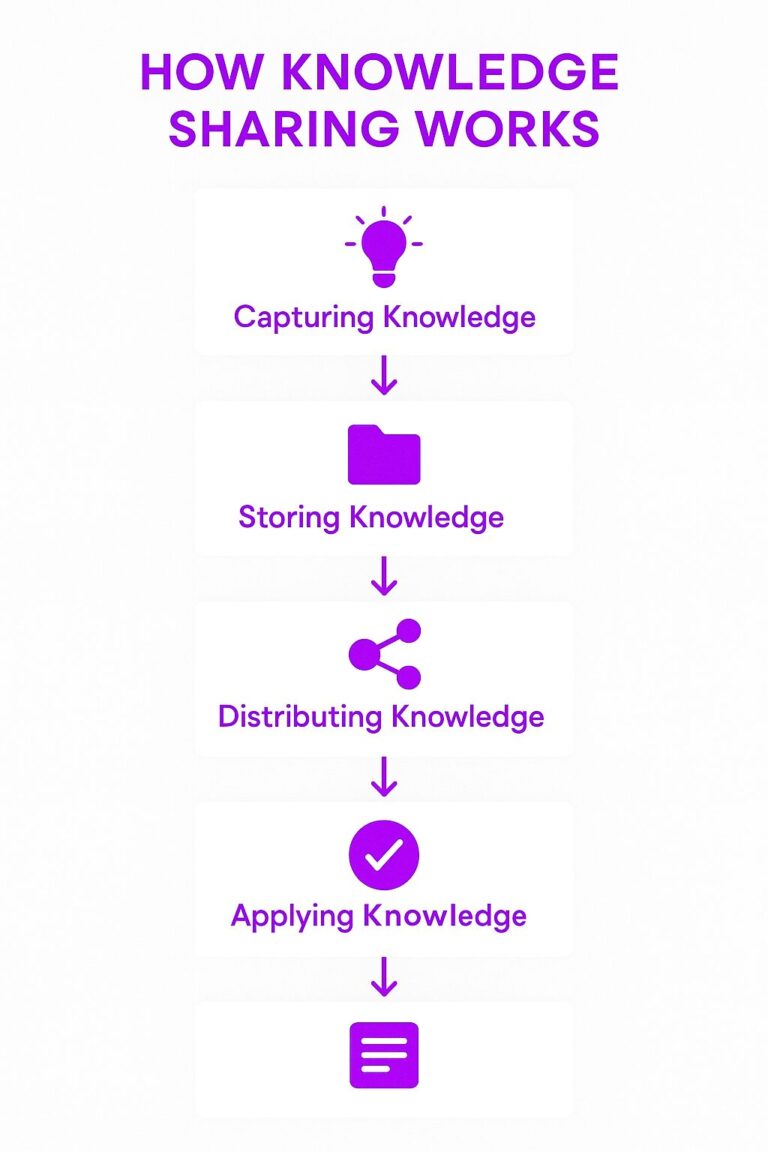

Ai-powered Invoicing Solutions

AI-powered invoicing solutions help remote service providers save time and reduce errors. These tools use artificial intelligence to create, manage, and send invoices quickly. They simplify the billing process, allowing providers to focus on their core work. AI tools also support customization and automation, making invoicing more efficient and professional.

Chatgpt Invoice Generation

ChatGPT can generate simple invoice templates using text prompts. Just describe your needs, and it creates a clear invoice format. You copy the result and paste it into Word or Google Docs. Then, fill in your business and client details. This method is fast and flexible for basic invoicing.

Invoice Bots And Plugins

Special invoice bots and plugins extend ChatGPT’s invoicing abilities. These add-ons offer features like PDF export and logo uploads. Many bots come with preset templates for different industries. They reduce manual work and enhance invoice appearance. Exploring plugin stores can reveal useful invoicing tools.

Automation With Zapier And Make.com

Zapier and Make.com connect invoicing with other apps automatically. They pull client data from tools like Notion or spreadsheets. Then, they create and send invoices without manual input. This automation saves time and avoids mistakes. It works well for businesses handling many clients or recurring bills.

Pdf And Logo Upload Features

Uploading PDFs and logos personalizes invoices and builds brand trust. AI invoicing tools often support adding your company logo easily. They also let you attach PDF versions of contracts or receipts. These features improve professionalism and help clients recognize your business. Custom invoices leave a lasting impression.

Credit: www.simprogroup.com

Pricing And Plans Comparison

Comparing pricing and plans helps remote service providers find invoicing tools within their budget. Each tool offers different options suited for freelancers and businesses. Understanding free trials, subscription costs, and scalability is key to choosing the right plan.

Free Plans And Trials

Many invoicing tools offer free plans or trial periods. Free plans usually include basic invoicing features. They suit freelancers with simple needs. Trial periods let users test premium features temporarily. This helps avoid unwanted expenses. Free options can handle limited invoices and clients. They provide a risk-free way to explore the software.

Subscription Costs

Subscription fees vary widely among invoicing tools. Prices depend on features, user limits, and support levels. Basic plans typically start from $10 to $20 per month. Advanced plans for more features can cost $30 or more. Monthly and yearly billing options are common. Yearly plans often offer a discount. Choosing the right subscription balances cost and functionality.

Best Value For Freelancers

Freelancers benefit from affordable plans with essential features. Look for tools offering unlimited invoices and clients. Customizable templates and payment tracking add value. Some platforms include time tracking or expense management. These extras help freelancers manage projects better. The best plans provide all needed features at a low price. Simple interfaces save time and reduce errors.

Scaling For Growing Businesses

Growing businesses need plans that support more users and clients. Upgraded plans usually unlock advanced reporting and automation. Integration with accounting or CRM software becomes important. Some tools offer team collaboration features. Flexible plans allow easy upgrades as business expands. Choosing scalable invoicing software avoids future migration hassles. This ensures smooth financial management as workload increases.

Choosing The Right Tool

Choosing the right invoicing tool is essential for remote service providers. The right software helps manage billing smoothly and saves time. Each business has unique needs. Picking a tool that fits those needs improves efficiency and reduces errors.

Assessing Business Needs

Start by listing your invoicing requirements. Consider how many clients you serve and the number of invoices you create monthly. Think about features like recurring invoices, expense tracking, or multiple currencies. Choose a tool that matches your current and future needs. Avoid paying for features you will never use.

Ease Of Use

Select a tool that is simple to learn and use. Remote providers often juggle many tasks. A clean, intuitive interface saves time. Check if the tool offers templates or automated reminders. Test the software with a free trial to see if it feels comfortable. A complicated tool can slow down your workflow.

Integration With Other Apps

Your invoicing tool should work well with apps you use daily. Syncing with accounting software, payment gateways, or project management apps saves effort. This integration reduces manual entry and errors. Look for tools that connect with popular apps like QuickBooks or PayPal. Smooth data flow keeps your business organized.

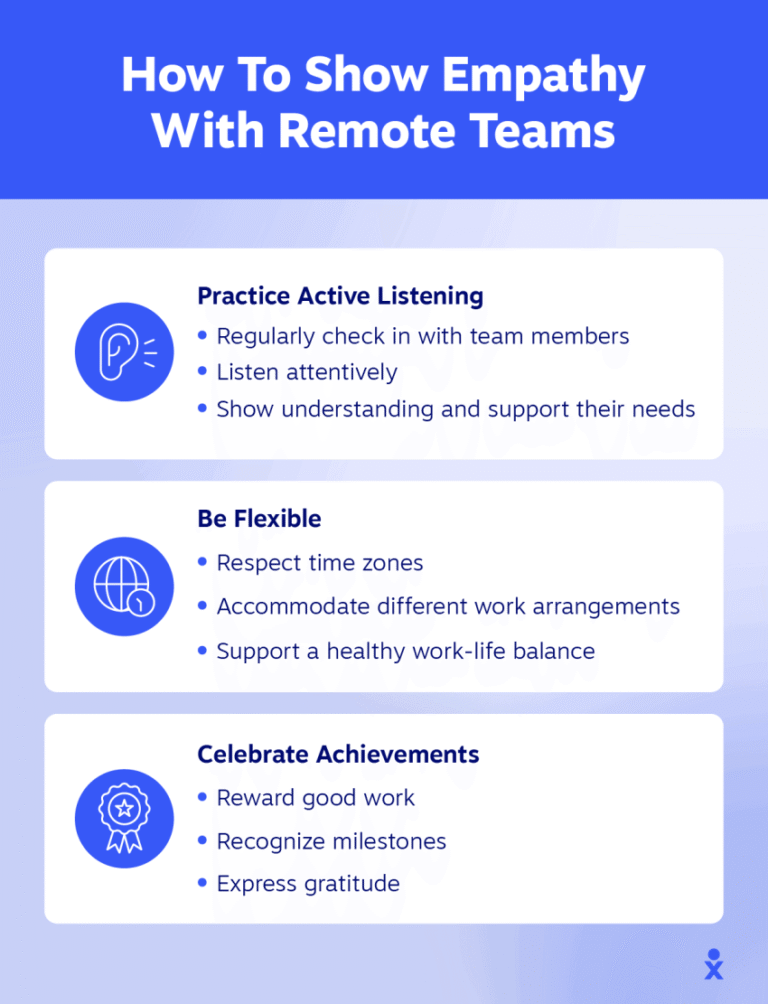

Customer Support And Resources

Reliable support is vital if problems arise. Check if the tool offers live chat, email, or phone support. Good documentation and tutorials help solve issues quickly. A helpful support team reduces downtime. Choose a provider that values customer service and updates its resources regularly.

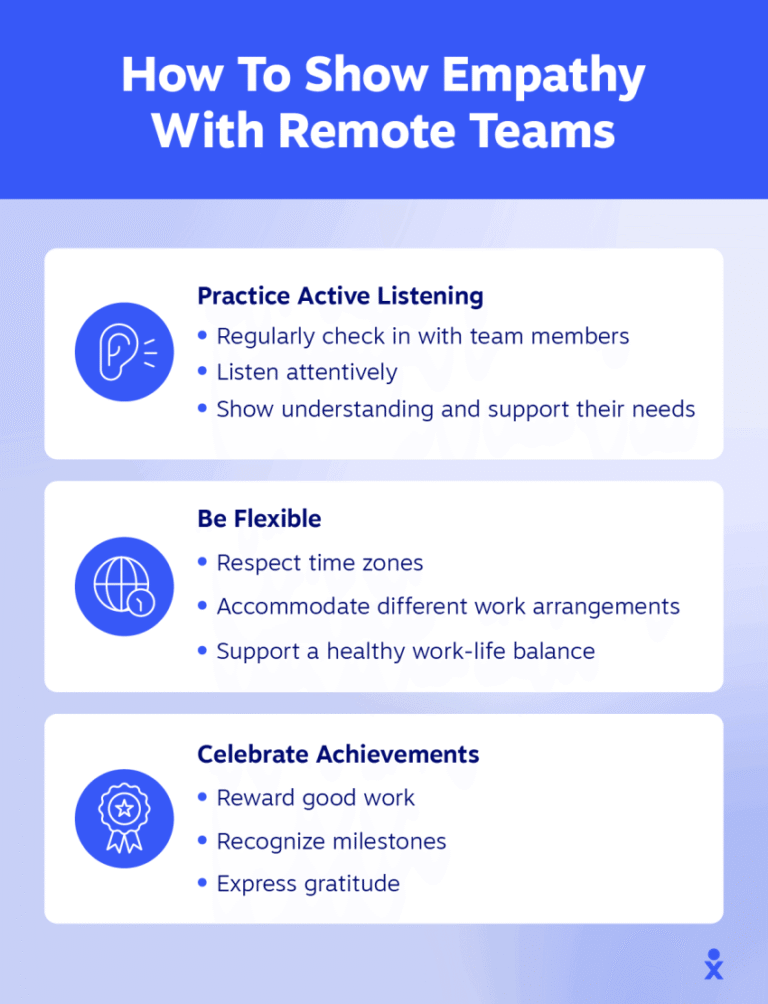

Tips For Effective Invoicing

Effective invoicing helps remote service providers get paid on time. Clear and accurate invoices build trust with clients. Simple steps can improve your invoicing process and save time. Follow these tips to make your invoices professional and secure.

Prompting Ai For Accurate Invoices

Use clear and specific prompts when asking AI to create invoices. Include details like client name, service description, and payment terms. Review the AI-generated invoice to correct any errors before sending. AI tools save time but need your input for accuracy. Start with a basic template and customize it for each client.

Maintaining Professionalism

Always use a clean and easy-to-read invoice format. Include your logo and contact information to appear professional. List services clearly with prices and dates. Set clear payment terms like due dates and accepted methods. Polite language encourages positive client relationships and timely payments.

Ensuring Payment Security

Choose invoicing tools that support secure payment options. Use encrypted platforms to protect client and business data. Avoid sharing sensitive information via email or unsecured links. Offer trusted payment methods like credit cards or PayPal. Secure invoices build client confidence and reduce fraud risk.

Following Up On Overdue Payments

Send polite reminders soon after a payment is overdue. Use automated tools to schedule follow-up emails. Keep messages professional and clear about the payment due. Offer assistance if the client has questions or issues. Regular follow-ups improve cash flow and reduce unpaid invoices.

Credit: peoplemanagingpeople.com

Frequently Asked Questions

What Is The Best Invoicing Software For Small Business?

The best invoicing software for small businesses includes Zoho Invoice for free plans, FreshBooks for trials, and Square Invoices for unlimited invoices. Harvest suits freelancers, while Stripe Invoicing excels in international sales. Choose based on your specific business needs and budget.

Can Chatgpt Generate An Invoice?

Yes, ChatGPT can generate basic invoice templates using text prompts. You can customize and export them manually. For advanced features like PDF downloads, use specialized ChatGPT plugins or invoice bots.

What Is The Cheapest Billing Software?

The cheapest billing software often includes free options like Zoho Invoice and ProfitBooks. These suit startups and freelancers well. They provide essential invoicing features without upfront costs. Choose based on your business needs and scalability.

Is There A Free Invoicing Software?

Yes, free invoicing software like Zoho Invoice, Square Invoices, and FreshBooks offer basic features. They suit small businesses and freelancers well.

Conclusion

Affordable invoicing tools help remote service providers save time and money. They simplify billing and keep payments organized. Choosing the right tool depends on your needs and budget. Most offer easy setups and clear interfaces. Using these tools can improve your cash flow and client relations.

Start with a free or low-cost option to test features. Managing invoices doesn’t have to be hard or expensive. Stay consistent, and your business will benefit in the long run.