Managing payroll can quickly become overwhelming, especially when you’re running a remote business. You want a solution that’s simple, reliable, and won’t break the bank.

But with so many options out there, how do you find affordable payroll software that fits your unique needs? You’ll discover the best payroll tools designed specifically for remote business owners like you—tools that save you time, reduce errors, and keep your team paid on time.

Keep reading to find the perfect fit for your business and take the hassle out of payroll forever.

Top Affordable Payroll Software

Choosing the right payroll software is key for remote business owners. Affordable options simplify paying employees and managing taxes. These tools save time and reduce errors. The following payroll software balances cost and features well. Each suits different remote business needs and budgets.

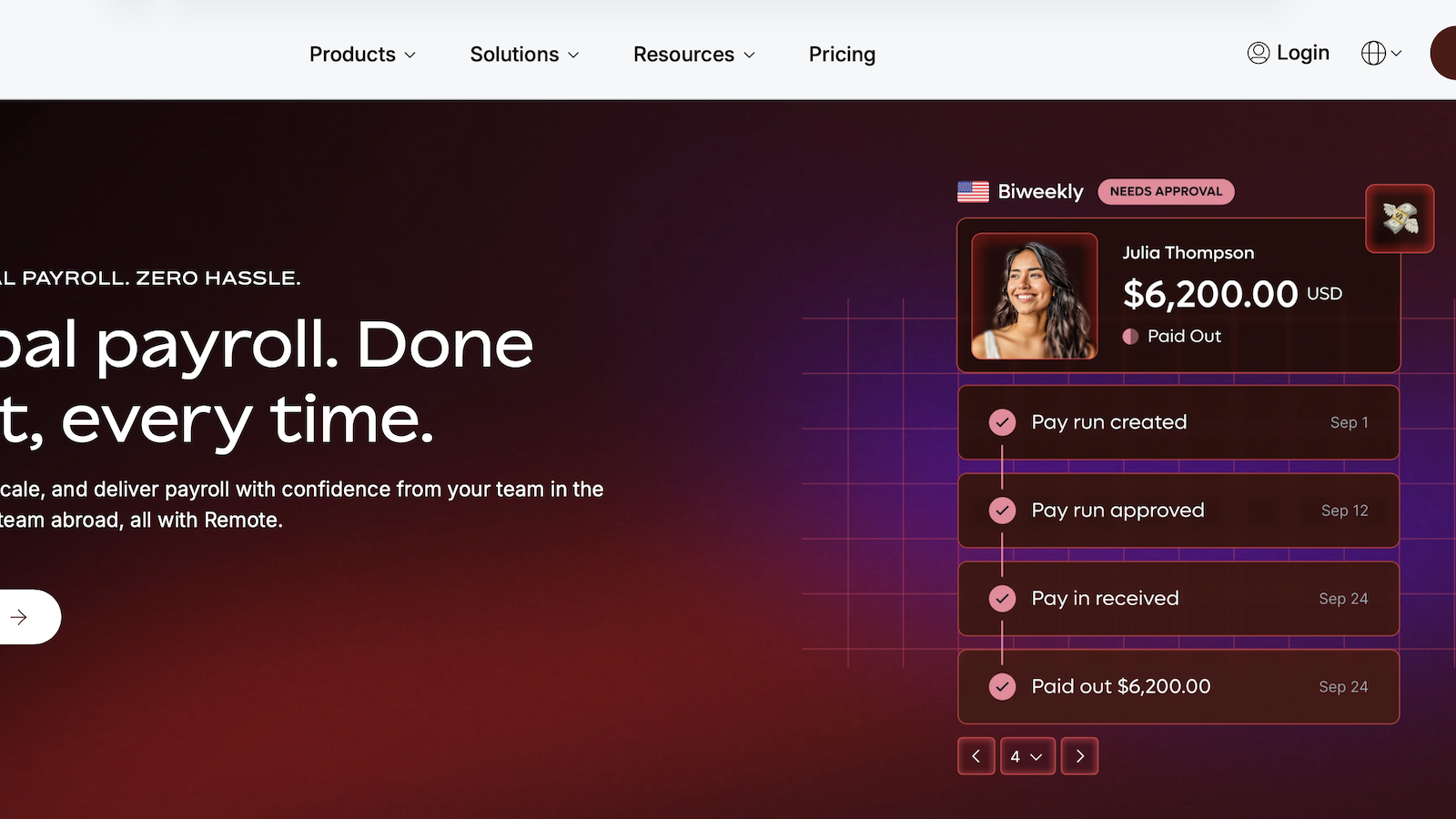

Deel

Deel supports global payroll and contractor payments. It handles multiple currencies and tax compliance. Deel offers automated payments and contract templates. This software fits businesses with remote teams worldwide. Pricing is competitive for startups and growing companies.

Remofirst

RemoFirst focuses on remote workforce payroll and benefits. It includes tax filings and compliance support. The platform integrates with time tracking tools. RemoFirst helps manage employees in various states or countries. It offers simple plans that suit small remote teams.

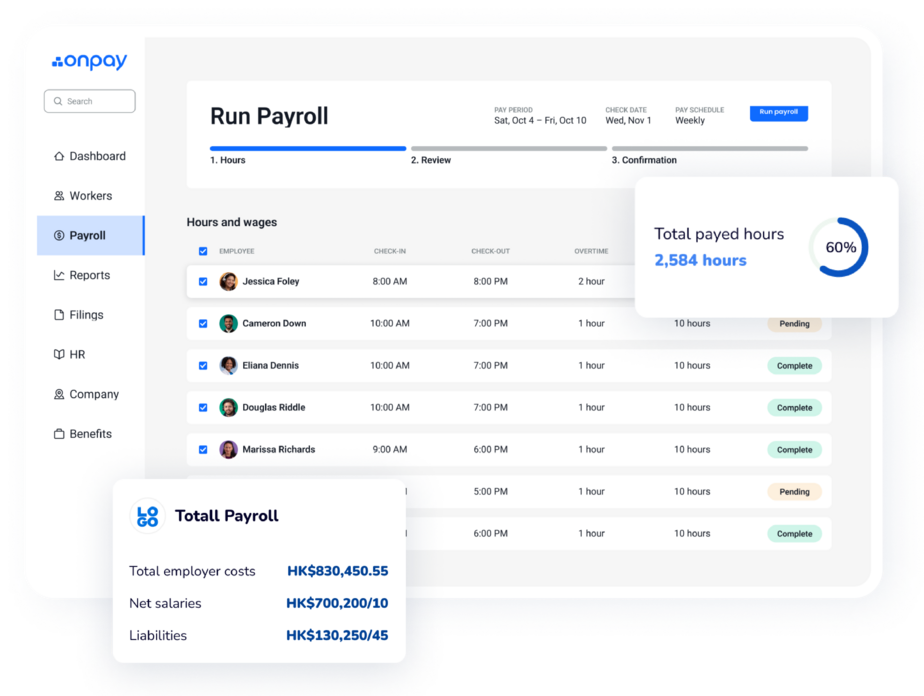

Onpay

OnPay provides full-service payroll with easy setup. It covers tax payments, filings, and year-end forms. OnPay works well for small businesses with remote workers. The software includes employee self-service portals. Its pricing is clear and affordable for most budgets.

Run Powered By Adp

RUN Powered by ADP offers scalable payroll solutions. It supports tax compliance and employee benefits management. The platform is user-friendly and mobile accessible. RUN suits remote businesses aiming to grow steadily. Pricing varies but remains affordable for small companies.

Credit: www.techradar.com

Free Payroll Options

Free payroll options provide remote business owners a cost-effective way to manage employee payments. These tools often cover basic payroll tasks without any initial fees. They allow new or small businesses to run payroll smoothly while keeping expenses low.

Choosing a free payroll solution helps save money on software costs. It also offers a chance to test features before upgrading to paid versions. Many free plans include essential functions like pay calculation and tax form generation.

Popular Free Software

Several free payroll software options are popular among remote business owners. Wave Payrolloffers a free plan with basic payroll and tax support. Payroll4Freeallows payroll for up to 25 employees without charge. eSmart Paycheckprovides free online payroll calculators and pay stub creation.

These tools focus on essential payroll management to keep processes simple. They suit businesses with straightforward payroll needs and smaller teams.

Limitations Of Free Plans

Free payroll plans often come with important limitations. They may restrict the number of employees or payroll runs per month. Some lack features like direct deposit, tax filing, or customer support.

Businesses with complex payroll needs may find free options insufficient. Upgrading to paid plans might be necessary for handling benefits, compliance, or multiple states.

Careful review of free software limitations helps avoid surprises. It ensures the chosen solution fits the business size and payroll complexity.

Features For Remote Businesses

Affordable payroll software designed for remote businesses offers essential features that simplify managing employees from different locations. These tools focus on ease of access, legal compliance, and employee empowerment. Each feature supports the unique needs of remote business owners.

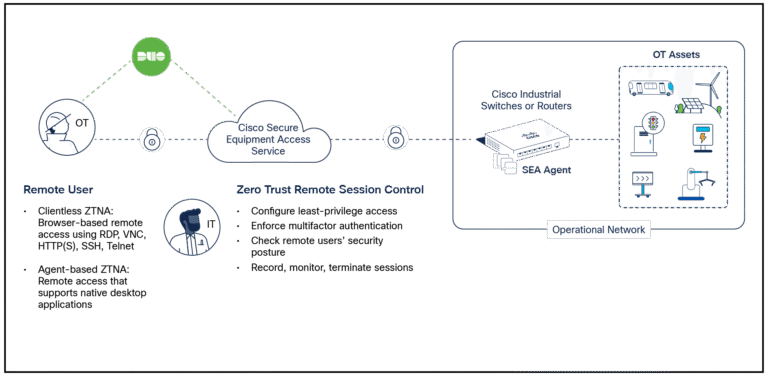

Cloud-based Access

Cloud-based payroll software allows business owners to manage payroll anytime. Access data securely from any device with internet connection. This flexibility suits remote teams spread across various locations. Updates happen in real-time, so information stays accurate and current.

Tax Compliance Tools

Tax rules vary by region and can be complex for remote businesses. Payroll software includes tools to calculate taxes correctly. It helps file tax forms on time and avoid penalties. Automatic updates ensure compliance with changing tax laws across states.

Employee Self-service

Employee self-service portals reduce administrative work for owners. Staff can view pay stubs, update details, and access tax forms independently. This feature improves transparency and communication. It also allows employees to resolve simple queries without extra support.

Multi-state Payroll Handling

Remote businesses often pay employees in multiple states. Payroll software handles different state tax rates and regulations automatically. It calculates wages, deductions, and benefits accurately by location. This reduces errors and saves time on manual adjustments.

Pricing Comparison

Comparing pricing helps remote business owners choose the best payroll software. Understanding costs clearly avoids surprises and keeps budgets on track. Many options exist, each with unique pricing structures. This section breaks down important pricing aspects for affordable payroll software.

Subscription Models

Payroll software often uses monthly or annual subscriptions. Some charge a flat fee, others add a cost per employee. Flat fees suit small teams with stable sizes. Per-employee fees scale with business growth but can get expensive. Some providers offer tiered plans. Higher tiers include more features and support. Choose a model matching your team size and growth plans.

Hidden Fees

Watch for extra costs beyond the base price. Setup fees, payroll runs, or tax filings may add charges. Some companies charge for phone support or reports. Overtime or bonus payments sometimes cost more. Hidden fees increase total expenses unexpectedly. Always read terms carefully to spot these costs early. Transparent pricing ensures no budget shocks later.

Cost Vs. Features

Compare prices against included tools and services. Cheaper software might lack tax filing or direct deposit options. More expensive plans often include compliance help and integrations. Assess which features your remote business needs most. Avoid paying for extras you won’t use. Balance cost with value for smooth payroll management.

Integration Capabilities

Integration capabilities are vital for affordable payroll software used by remote business owners. These features allow seamless connection with other tools, reducing manual data entry and errors. Smooth integrations save time and improve business efficiency.

Payroll software that integrates well supports various essential business systems. This ensures all your data flows correctly between platforms. It helps keep finances, employee hours, and HR information up to date automatically.

Accounting Software

Payroll software that connects with accounting programs simplifies financial management. It automatically updates payroll expenses and tax information in your books. This reduces mistakes and keeps your accounts accurate. Popular accounting tools like QuickBooks or Xero often link with payroll systems.

Time Tracking Tools

Integration with time tracking tools ensures employee hours are recorded precisely. This data flows directly into payroll, preventing errors in wage calculations. Remote teams benefit from this as their work hours are tracked in real time. Common time tracking apps such as TSheets or Toggl work well with payroll software.

Hr Platforms

Linking payroll with HR platforms streamlines employee management tasks. Changes in employee status or benefits update automatically in payroll systems. This avoids double entry and reduces administrative work. HR tools like BambooHR or Gusto integrate easily with affordable payroll software.

User Experience

User experience plays a key role in choosing affordable payroll software for remote business owners. A smooth and intuitive experience saves time and reduces errors. Remote owners benefit from software that is simple to use and reliable. The right payroll tool should feel natural from the start.

Ease Of Setup

Payroll software must be quick to install and configure. Clear instructions help users complete setup without stress. Automated data import from spreadsheets or accounting tools speeds up the process. A straightforward setup avoids confusion for those new to payroll software. This ensures businesses can start paying employees promptly and accurately.

Customer Support

Reliable customer support helps solve issues fast. Support teams should be easy to reach by phone, chat, or email. Helpful guides and FAQs provide immediate answers. Good support reduces downtime and keeps payroll running smoothly. For remote owners, quick help means less worry about payroll mistakes.

Mobile App Availability

Mobile apps let business owners manage payroll on the go. Apps should be user-friendly and offer key features like pay runs and report viewing. Notifications keep users informed about payroll deadlines and updates. Mobile access adds flexibility for owners working from different locations. It makes payroll management convenient and efficient anytime.

Security And Compliance

Security and compliance are vital for remote business owners using payroll software. Protecting sensitive employee data and meeting legal standards prevents costly risks. Choosing software that prioritizes these aspects ensures smooth, safe payroll operations.

Data Protection Measures

Reliable payroll software uses strong encryption to secure data. It limits access to authorized users only. Regular backups protect information from loss or damage. Multi-factor authentication adds an extra security layer. These features keep employee and company data safe.

Regulatory Updates

Payroll rules change frequently at local and national levels. Good software updates automatically to reflect new laws. It helps avoid fines by ensuring payroll processes meet current regulations. This saves time and reduces stress for remote business owners.

Audit Support

Audit support simplifies tax and compliance reviews. The software organizes payroll records clearly and stores them safely. It generates reports quickly for auditors or tax authorities. This feature makes audits less disruptive and more efficient.

Credit: peoplemanagingpeople.com

Choosing The Right Software

Choosing the right payroll software is key for remote business owners. The software must match your business needs. It should simplify payroll tasks and save time. Picking a tool that fits well avoids costly changes later.

Business Size Considerations

Small businesses need simple, easy-to-use software. It should handle basic payroll functions well. Larger businesses require more advanced features. Look for software that supports multiple employees and payroll schedules. Ensure it complies with tax laws for your business size.

Feature Prioritization

Focus on essential features first. Automatic tax calculations reduce errors and save time. Direct deposit options improve payment speed and convenience. Employee self-service portals let staff access pay details easily. Choose software with strong security to protect sensitive data.

Scalability

Your business will grow. Pick software that can grow with you. It should add new users and features without extra costs. Scalable software prevents switching systems often. This saves money and reduces disruption over time.

Credit: onpay.com

Frequently Asked Questions

Which Payroll Software Is The Cheapest?

Deel, RemoFirst, OnPay, and RUN Powered by ADP rank among the cheapest payroll software options. Pricing varies by features.

Is There Free Payroll Software For Small Businesses?

Yes, free payroll software exists for small businesses, offering basic payroll processing and tax filing features without cost.

What Is The Best Payroll For Small Businesses?

Gusto offers the best overall payroll for small businesses with easy setup and tax automation. OnPay suits tax compliance needs. QuickBooks Payroll integrates well with accounting. ADP RUN supports growing businesses. Paychex Flex provides personalized support. Choose based on your specific business needs.

How Much Is Adp Payroll For Small Businesses?

ADP payroll pricing for small businesses starts around $59 monthly plus $4 per employee. Costs vary by features and location.

Conclusion

Choosing affordable payroll software helps remote business owners save time and money. Simple tools keep payroll tasks easy and accurate. Reliable software supports tax compliance and employee payments. Many options fit small budgets without sacrificing features. Prioritize software that matches your business size and needs.

Keeping payroll organized reduces stress and boosts efficiency. Start with a free trial to find the best fit. Managing payroll doesn’t have to be costly or complex. Find the right tool and focus more on growing your business.