Are you running a remote business and worried about keeping your online payments safe? You’re not alone.

Every day, cyber threats grow smarter, targeting businesses just like yours. But securing your payments doesn’t have to be complicated or overwhelming. You’ll discover simple yet powerful ways to protect your transactions, keep your customers’ trust, and safeguard your hard-earned revenue.

Ready to take control and make your online payments bulletproof? Let’s dive in and secure your remote business together.

Secure Payment Methods

Choosing secure payment methods is crucial for remote businesses. These methods protect sensitive information from theft and fraud. They build trust with customers and keep transactions safe.

Secure payment methods reduce risks and ensure smooth business operations. Selecting reliable options helps prevent financial losses and identity theft. Two popular secure payment methods are credit cards and digital wallets.

Credit Cards Benefits

Credit cards offer strong fraud protection by limiting your liability. They allow easy dispute resolution if a purchase goes wrong. Card details are encrypted, keeping information safe from hackers.

Credit cards also provide chargeback options, which protect your money in case of fraud. Many cards include alerts for unusual activity, helping you spot threats quickly. Using credit cards adds a layer of security to online payments.

Advantages Of Digital Wallets

Digital wallets use tokenization, replacing real card numbers with unique codes. This prevents merchants from seeing your actual card details. Biometric security, like fingerprints, often verifies transactions.

Digital wallets store card information in one place, reducing exposure to multiple websites. They support multi-factor authentication, making unauthorized access harder. Digital wallets simplify payments while enhancing security for remote businesses.

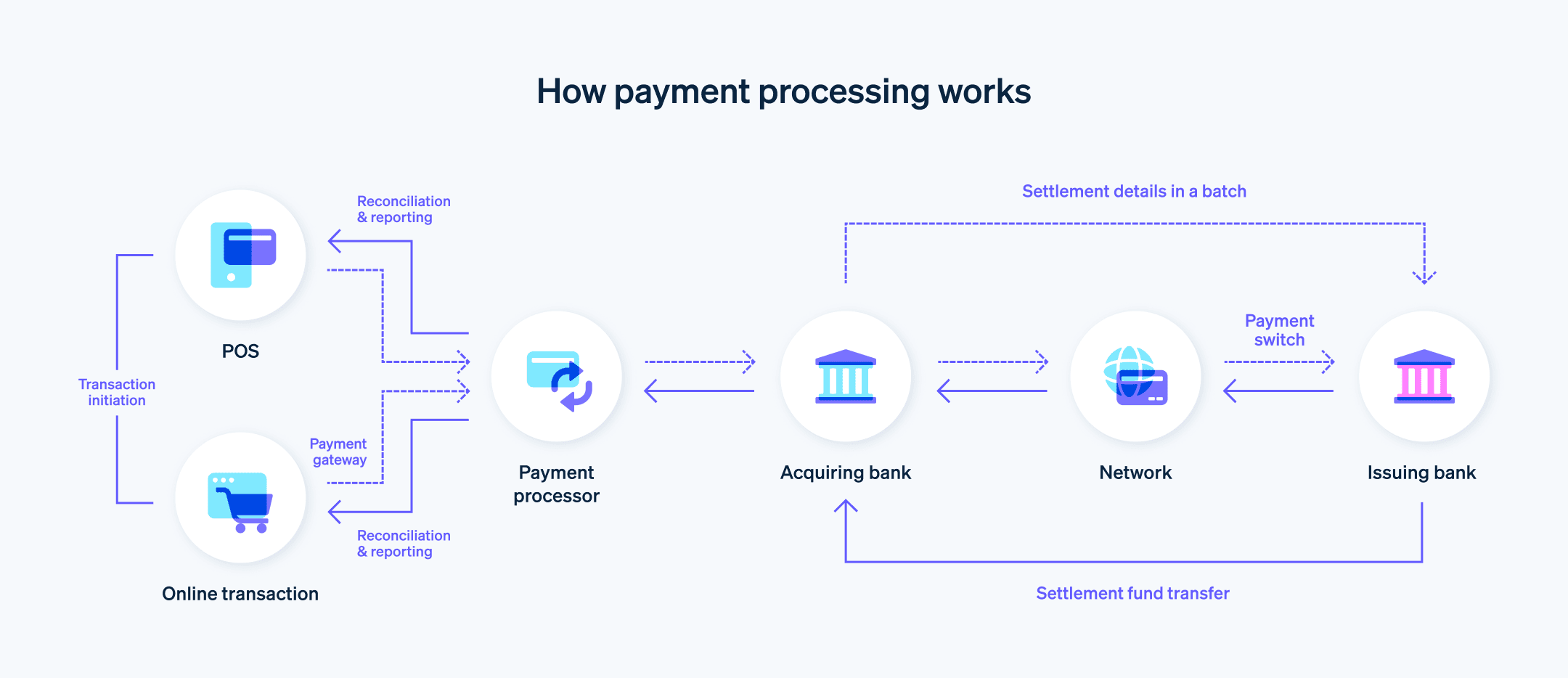

Credit: stripe.com

Key Security Features

Securing online payments is vital for remote businesses. Strong security features protect sensitive data from theft and fraud. Understanding key security features helps businesses reduce risks and build customer trust.

These features use advanced technology to safeguard payment information. They add layers of protection beyond simple passwords or encryption. Let’s explore some essential security features that enhance payment safety.

Tokenization Explained

Tokenization replaces sensitive payment details with unique codes. These codes have no real value outside a specific transaction. This means actual card numbers are never exposed during payment processing. Tokenization limits the risk of data breaches and fraud. It keeps customer information safe, even if a hacker accesses the system.

Multi-factor Authentication

Multi-Factor Authentication (MFA) requires more than one verification step. Users must provide additional proof besides a password. This can be a code sent to a phone or an authentication app. MFA makes it harder for attackers to access accounts. It greatly reduces unauthorized payments and account takeovers.

Biometric Authorization

Biometric authorization uses unique physical traits to verify identity. Common methods include fingerprints, facial recognition, or voice recognition. Biometrics add a strong security layer that is difficult to fake. Remote businesses can use biometric checks to approve payments securely. This technology provides quick and reliable authentication.

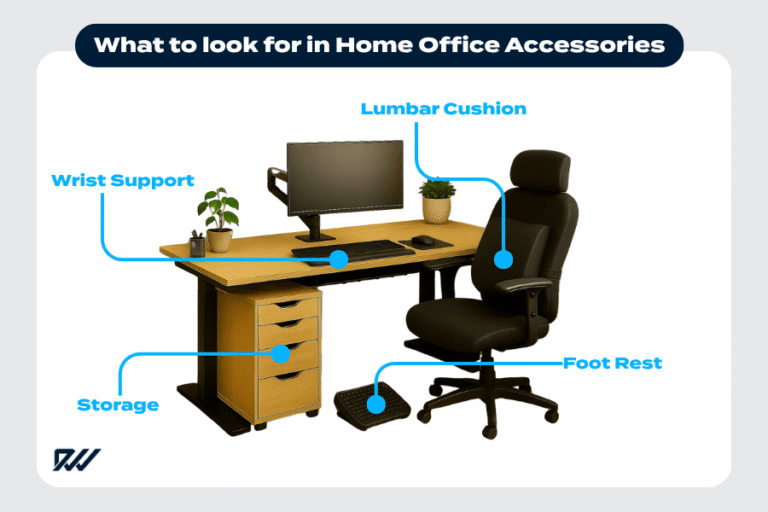

Best Practices For Online Payments

Securing online payments is essential for remote businesses to protect sensitive financial information. Following best practices helps reduce risks of fraud and theft. These steps create a safer payment environment for both businesses and customers.

Using Virtual Cards

Virtual cards act as temporary credit cards for online purchases. They limit exposure of your real card details. Each virtual card can have spending limits and expiration dates. This control reduces the chance of fraud. Many banks and digital wallets offer virtual card services. Use them especially for one-time or unknown merchants.

Shopping On Secure Websites

Always check for “https://” at the start of the website address. This indicates the site uses encryption to protect data. Look for a padlock icon in the browser bar. Avoid sites with warnings or no security certificates. Secure sites prevent hackers from stealing payment information during transactions.

Verifying Merchant Reputation

Research merchants before making payments. Read customer reviews and ratings on trusted platforms. Check if the company has clear contact details and return policies. Avoid merchants with many complaints or no online presence. Trusted merchants reduce the risk of scams and lost money.

Regular Account Monitoring

Check your bank and credit card statements frequently. Look for unauthorized or suspicious transactions. Set up alerts for large or unusual charges. Report any strange activity to your bank immediately. Regular monitoring helps catch fraud early and protects your funds.

Safe Ways To Receive Payments

Receiving payments safely is vital for remote businesses. It protects your income and builds trust with clients. Choosing secure methods reduces fraud risks and errors. This section covers reliable options to receive payments securely.

Popular Digital Wallets

Digital wallets like PayPal, Apple Pay, and Google Pay offer quick, secure payment options. They use tokenization, hiding your real card details during transactions. Biometric security, such as fingerprint or face recognition, adds extra protection.

These wallets limit exposure of sensitive information by sharing it only once. Many support multi-factor authentication, making unauthorized access harder. Customers appreciate the ease and security digital wallets provide.

Bank Transfers And Wire Services

Bank transfers and wire services are reliable for large payments. They send money directly from one bank account to another. This method reduces risks linked to cash or check payments.

Always confirm recipient bank details before sending funds. Use banks with strong security measures and encryption. Keep records of all transactions to track payments and resolve disputes.

Avoiding Overpayment Scams

Overpayment scams trick businesses into refunding extra money sent by fraudsters. Watch for suspicious payment amounts exceeding invoices. Never refund overpayments before confirming the transaction’s legitimacy.

Verify payments through your bank or payment provider. Be cautious with new or unknown clients. Educate your team about such scams to prevent losses.

Protecting Remote Business Transactions

Protecting remote business transactions is vital to keep customer trust and avoid financial losses. Remote businesses face unique security challenges due to dispersed teams and digital payment methods. Implementing strong safeguards ensures payment data stays safe from hackers and fraudsters. Simple but effective steps help create a secure environment for all online payments.

Encrypting Payment Data

Encrypting payment data hides sensitive information during transmission. It changes data into unreadable code for outsiders. Use Secure Socket Layer (SSL) or Transport Layer Security (TLS) protocols on payment pages. Encryption protects credit card numbers, personal details, and transaction records. This makes it very hard for attackers to steal or misuse data.

Employee Training On Security

Employees must learn how to handle payment information safely. Train staff on recognizing phishing emails and suspicious links. Teach them to use strong passwords and secure Wi-Fi connections. Regular training updates keep security top of mind. Well-informed employees reduce the risk of accidental data leaks or breaches.

Implementing Fraud Detection Tools

Fraud detection tools monitor transactions for unusual activity. These tools flag high-risk payments for review before approval. Use software that analyzes patterns like location, amount, and device used. Early detection helps stop fraudulent transactions quickly. This protects both the business and its customers from financial harm.

Credit: www.safetydetectives.com

Credit: razorpay.com

Frequently Asked Questions

What Is The Most Secure Method Of Online Payment?

The most secure online payments use credit cards or digital wallets like PayPal and Apple Pay. They offer fraud protection, tokenization, and multi-factor authentication. Always shop on secure websites and monitor accounts regularly to prevent scams and unauthorized charges.

What Is The Safest Way To Accept Online Payments?

Thesafest way to accept online payments is using trusted digital wallets or credit cards with multi-factor authentication. Always use secure, reputable websites and monitor transactions regularly to prevent fraud. Tokenization and encryption protect sensitive data during each transaction, ensuring maximum security.

How To Make Secure Online Payments?

Use credit cards or digital wallets with multi-factor authentication for online payments. Shop only on secure, reputable websites. Enable virtual cards and monitor accounts regularly to detect suspicious activity. Verify merchant reputation before purchases to avoid scams and protect your financial information.

How Can Businesses Address The Security Concerns Of Online Payments In E-commerce?

Businesses can address online payment security by using SSL encryption, enabling multi-factor authentication, and partnering with trusted payment gateways. They should verify merchant reputations, monitor transactions regularly, and educate customers on safe payment practices to reduce fraud risks effectively.

Conclusion

Securing online payments protects your business and customers alike. Always choose trusted payment methods like credit cards or digital wallets. Use multi-factor authentication to add extra safety layers. Shop and sell only on secure, encrypted websites. Regularly monitor accounts to spot any unusual activity.

Small steps help prevent fraud and build customer trust. Stay informed about new security tools and practices. Keeping payments safe supports your remote business success.